Payments

End-to-end Stablecoin Payments

From flexible payments acceptance to automated settlements, Cobo delivers the complete infrastructure you need to scale your stablecoin payments business.

Trusted By PAYMENTS LEADERS

Built for modern payments

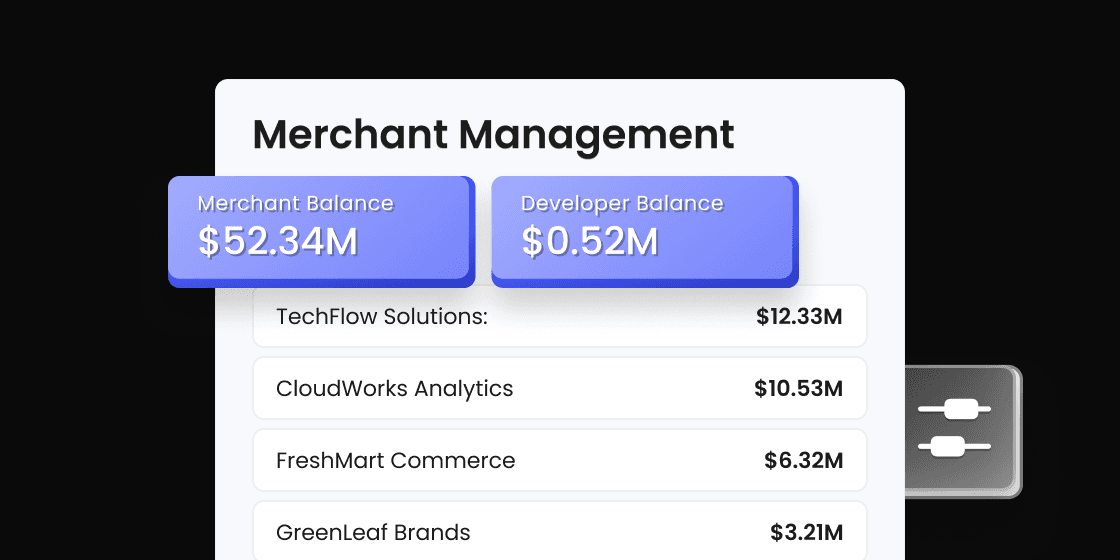

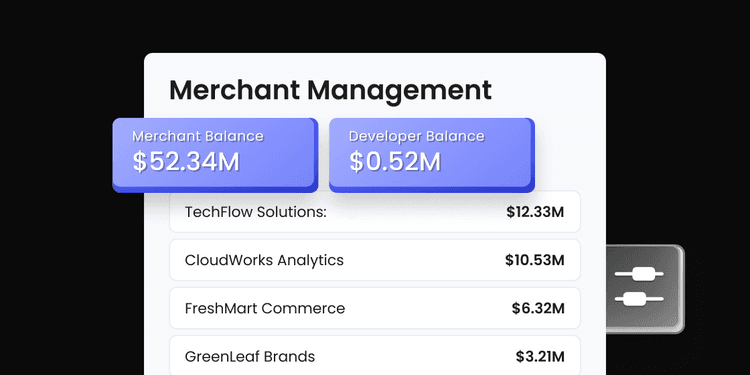

Cross-border Payment Service Providers (PSPs)

Enable secure escrow transactions for cross-border PSPs with flexible commission structures and automated settlements.

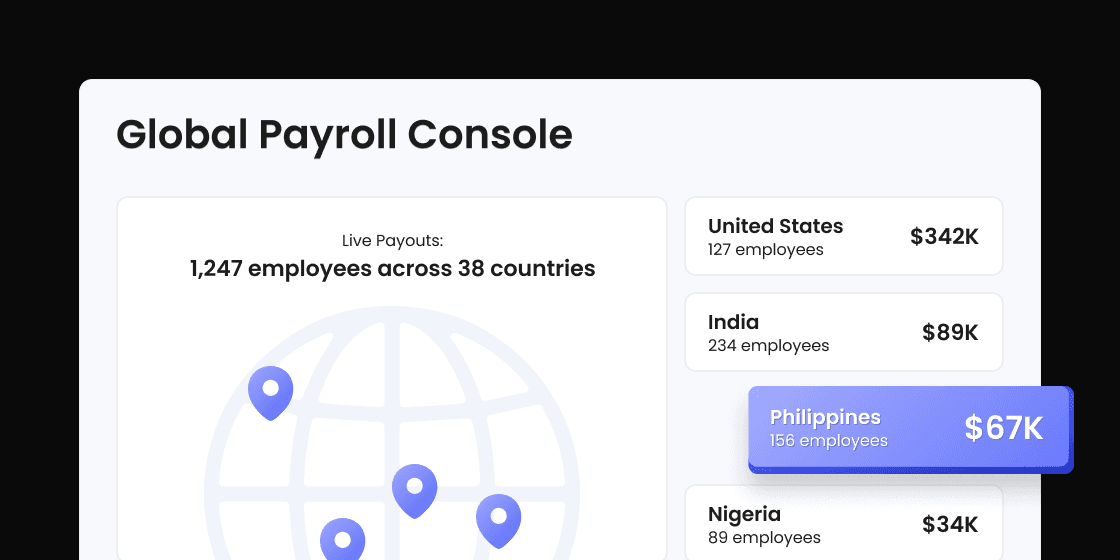

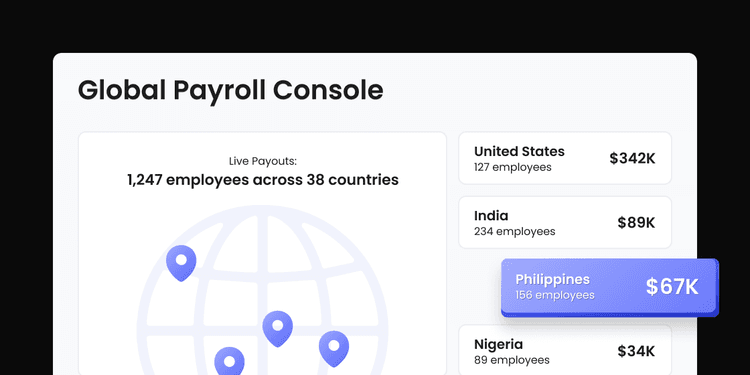

Global payroll and EOR services

Optimize global payroll with automated batch payouts to employees in any country, including long-tail markets and emerging economies.

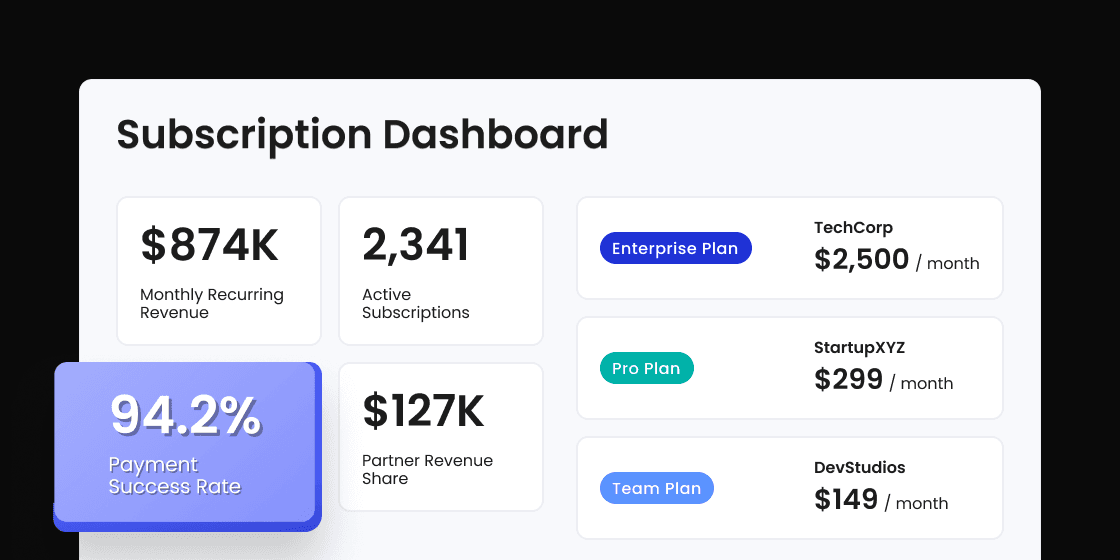

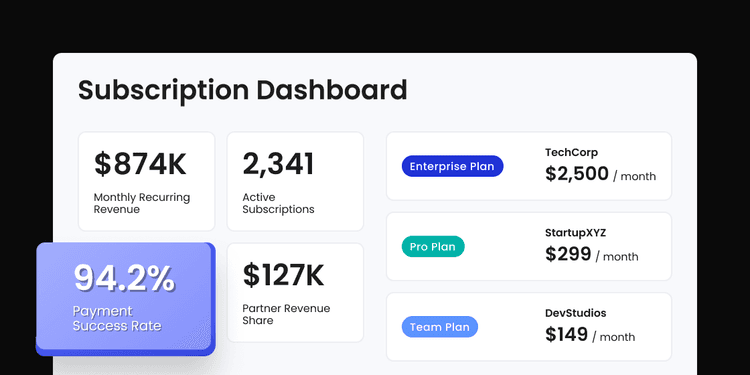

B2B SaaS platforms

Comprehensive billing solutions for SaaS merchants, including subscription management, partner revenue sharing, and automated reconciliation.

Crypto-native infrastructure

Support rewards distribution and operational expenses payments with high-throughput batch payouts and intelligent address management.

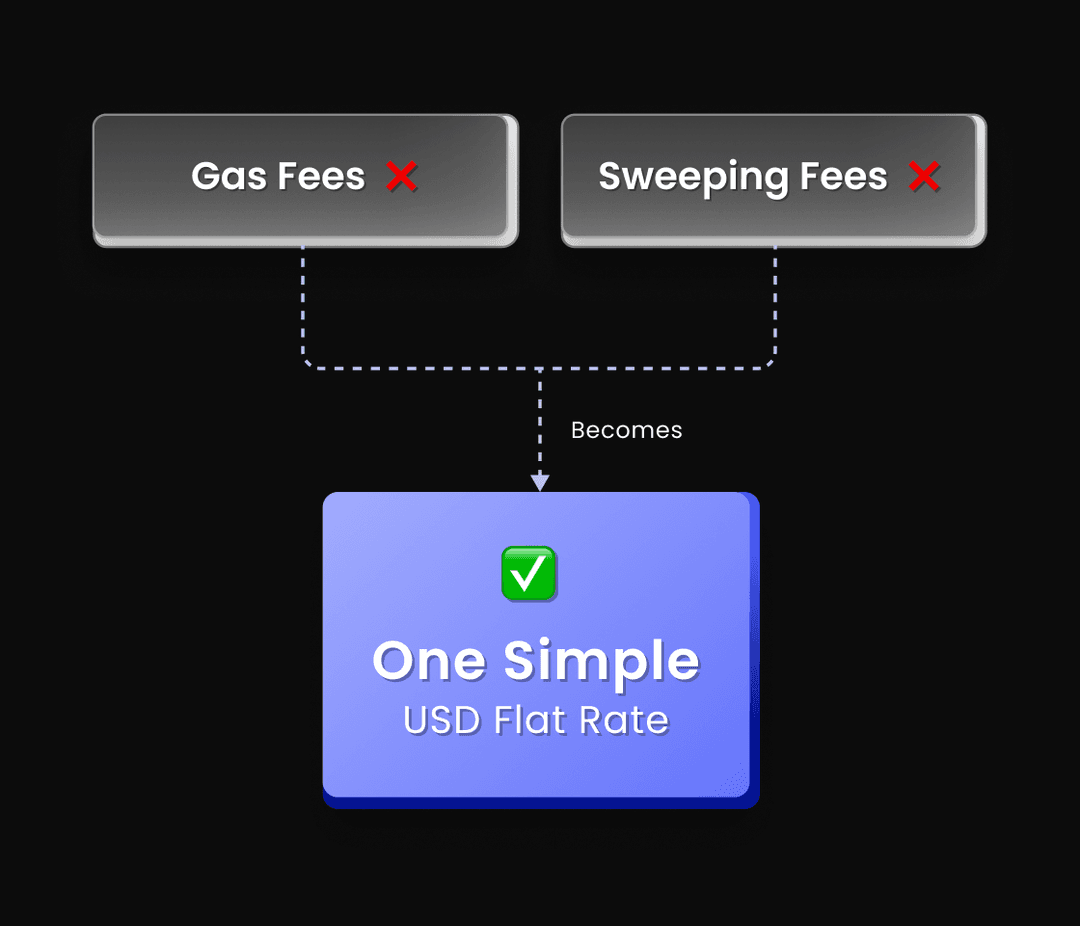

All-inclusive pricing

Transparent commission-based model

Pay a simple USD-based flat rate for all transactions, with gas fees and technical complexities handled by us.

Simplified fee payments through Fee Station

Use Fee Station to pay and manage all commission fees with automated deduction and balance monitoring for clear, audit-ready billing.

Flexible pay-in options

Choose from a wide array of pay-in options tailored to your business needs.

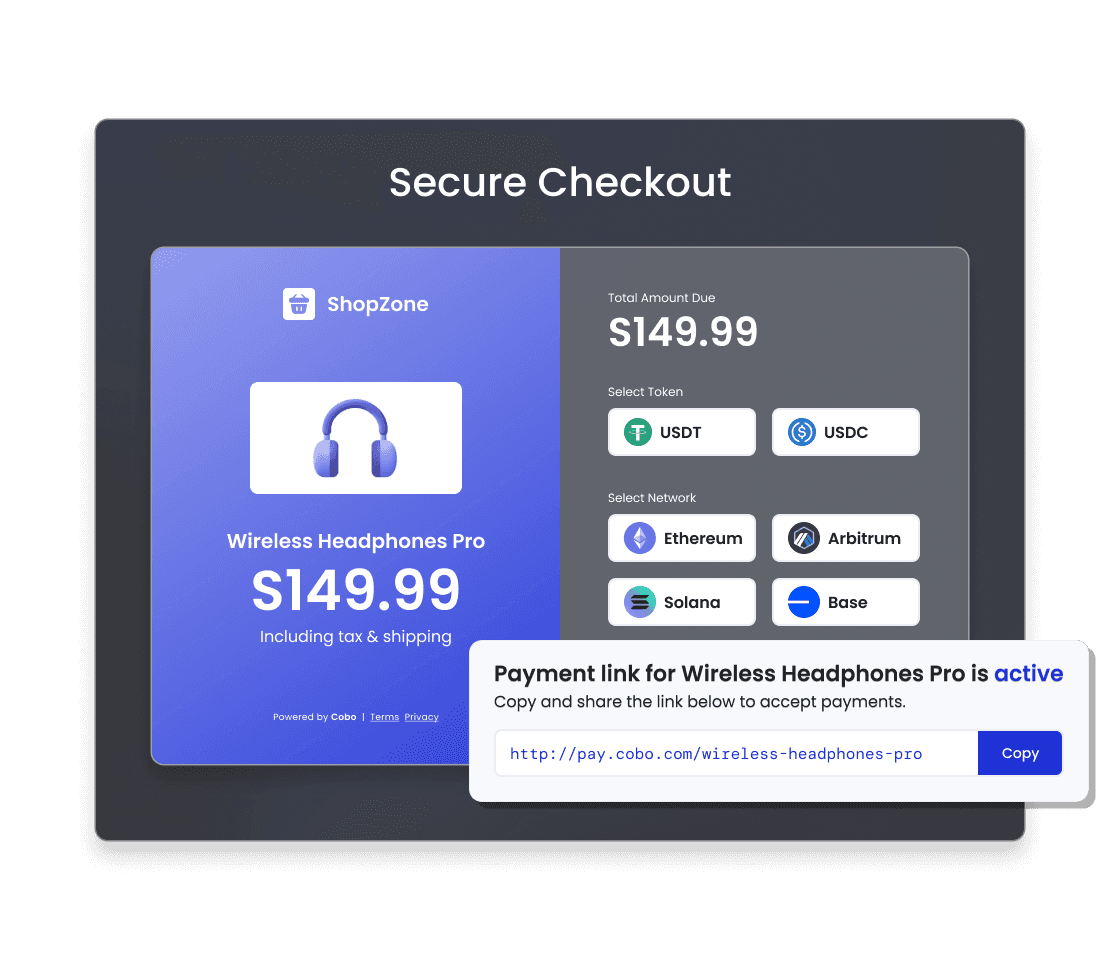

Fixed addresses for unlimited deposits

Order-based payments with preset amounts

Automated subscription billing with recurring deductions

Advanced digital asset management

Optimize financial operations through automated settlement, smart reconciliation, and access to a vast network of liquidity providers.

Configure automatic settlement processes tailored to your merchant requirements.

Leverage smart reconciliation technology to efficiently resolve payments discrepancies

Convert your received digital assets across different chains and tokens to meet diverse portfolio needs.

Access global liquidity through our extensive OTC network.

Battle-tested security & compliance

We combine regulatory coverage, automated monitoring, and proven risk controls to keep your payments secure.

Regulatory licenses across multiple jurisdictions, supported by automated AML/KYT monitoring.

Flexibly adapt compliance and security settings to your business needs.

A battle-tested risk engine defending against both internal and external threats.

FAQs

Our web interfaces, payment links, APIs and SDKs enable integration in as little as one week, with dedicated technical support and detailed documentation to accelerate your deployment.

We hold regulatory licenses in multiple regions and have established automated AML/KYT monitoring processes. We operate with ISO 27001, SOC 2 Type 1 and SOC 2 Type 2 certifications, ensuring the highest standards of security and compliance.

Our solution supports payments in major stablecoins across leading blockchains including Ethereum, Solana, BNB Smart Chain, and more. For a complete list of supported networks and tokens, see Supported chains and tokens.