Secure Digital Asset Custody for Institutions

The trusted digital asset wallet platform

Access 4 wallet technologies, plug-and-play APIs, a multi-layer security matrix, and more–all in one platform. Empower your blockchain innovations with Cobo.

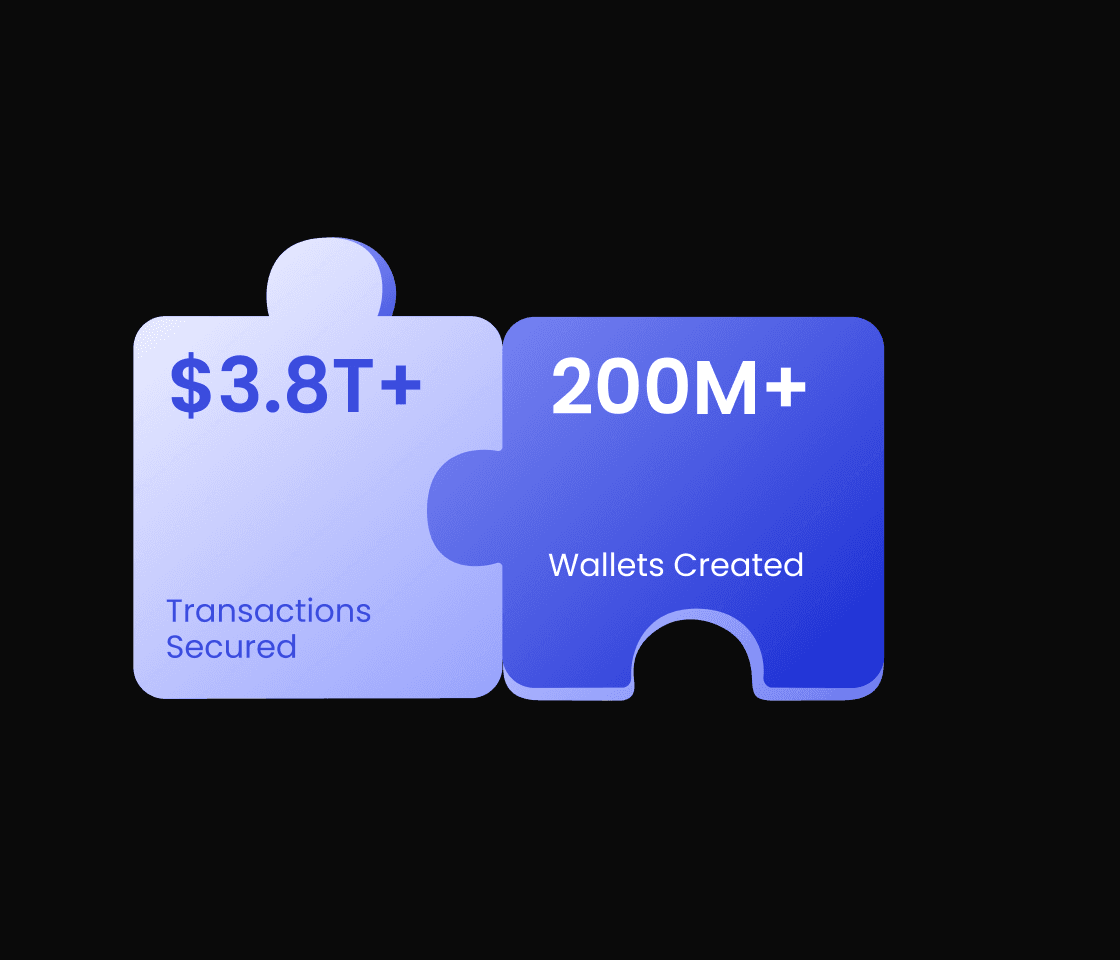

Trusted by Leading Institutions Across the Globe

Security You Can Trust

Trusted Since 2017. Zero Breaches.

8 years of uninterrupted security — protecting billions in assets for institutions around the world.

Custodial Wallets

Secured by hardware-based isolation using HSMs and Intel® SGX.

MPC Wallets

Distributed TSS nodes run inside Trusted Execution Environments (TEEs) for tamper-proof signing.

Audits & Pen Testing

Top-tier security firms conduct regular audits, while independent labs perform routine pen testing.

24/7 Monitoring

We maintain round-the-clock monitoring, real-time alerting, and full incident response readiness.

Trusted by Global Leaders

Chosen by top exchanges, funds, and fintechs managing billions in digital assets.

Certified & Licensed

SOC 2 Type II certified, ISO 27001 compliant, and licensed in Hong Kong and the United States.

Compliance-Ready

Integrated AML/KYT with top-tier partners, Chainalysis and Elliptic.

Built-In Policy Engine

Enforce secure operations with customizable risk controls for every user, wallet, and transaction.

Wallet-as-a-Service (WaaS)

Build on battle-tested infrastructure. Launch faster, scale smarter, and stay secure.

Wallet-as-a-Service (WaaS)

Build on battle-tested infrastructure. Launch faster, scale smarter, and stay secure.

Use one API & SDK stack for four wallet types — Custodial, MPC, Smart Contract, and Exchange Wallets.

Access 80+ chains, 3,000+ tokens — launch new tokens instantly with our self-service tools.

Enforce granular policy controls for secure, audit-ready operations.

Exchanges

Secure wallets. Instant token onboarding. Built for high-frequency platforms.

Exchanges

Secure wallets. Instant token onboarding. Built for high-frequency platforms.

List new tokens instantly with self-service tools.

Protect user funds with a hot-warm-cold wallet setup built for trading efficiency.

Reduce operational overhead with automated token sweeping, gas fee payments, and policy controls.

Payments

Settle stablecoin flows across chains with built-in AML/KYT compliance.

Payments

Settle stablecoin flows across chains with built-in AML/KYT compliance.

Accept, convert, and settle with secure fiat <-> crypto ramps.

Enable pay-ins and payouts through a single API.

Power high-frequency payments with automated token sweeping, wallet address rotation, and volume-based settlements.

Treasury & Asset Management

Safeguard and grow your digital assets with full visibility and control.

Treasury & Asset Management

Safeguard and grow your digital assets with full visibility and control.

Stake idle assets to earn yield with institutional safeguards.

Generate audit-ready reports for finance and compliance teams.

Secure 90–95% of assets in cold storage while maintaining fast-access liquidity.

Hear it from our customers

Lin Chen

Head of APAC Business Development | Deribit

Hear it from DeribitWhy Choose Our Digital Asset Custody Services?

Flexible Digital Asset Wallets for Institutions

Custodial, MPC, Smart Contract & Exchange Wallets — complete architecture to fit your business operations.

Industry’s Widest Multi-Chain Support

Manage assets across 80+ blockchains, maximizing flexibility and token coverage for your clients.

Maximize Operational Efficiency

Automate sweeping, gas fee payments, AML screening, and more — reduce manual overhead and operational risk.

24/7 Dedicated Support

Instant, personalized support with responses in under 5 minutes.

3,000+ tokens across 80+ chains

Widest coverage in the industry, with new tokens added every week.

See the full list here.

Scale with Cobo Today